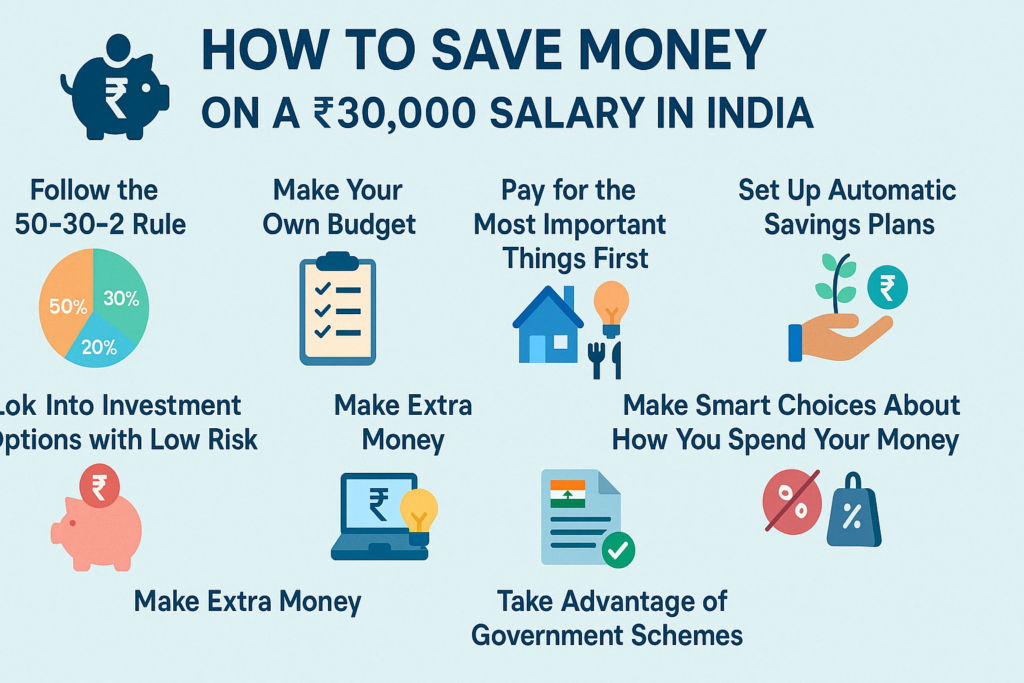

How to save money on a 30000 salary in India

📍 Beginning: How to save money on a 30000 salary in India

In India, making ₹30,000 a month might not seem like enough, especially since the cost of living is going up. Still, it is possible to save and build a safe financial future with careful planning and good habits. This book gives useful tips for people who are trying to make it in life with a ₹30,000 salary.

1. Follow the 50-30-20 rule

The 50-30-20 rule is one of the most important parts of budgeting:

- 50% for Essentials: Set aside ₹15,000 for things like rent, food, and utilities that you need.

- 30% for Savings and Investments: Put 9,000 into building your future finances.

- 20% for Personal Desires: Spend ₹6,000 on fun things or things that aren’t necessary.

This system makes sure that you can live a healthy life and encourages regular saves. ✅

2. Make your own budget

Start by making a list of all your monthly cash and spending. Find places where you can cut back on spending. Use simple worksheets or planning apps to keep an eye on and make changes to your financial plan on a regular basis. 📊

3. Pay for the most important things first

Focus on what you need:

- Housing: Look for cheap places to stay, maybe by splitting the rent with other people.

- Food: Make food at home to save money on eating out.

- Utilities: Use less water and electricity to lower your bills.

Paying attention to these places can help you save a lot of money every month. 🏠🥘

4. Set up automatic savings plans

Set up your salary to go straight into a savings account or an investment plan as soon as you get paid. This “pay yourself first” method helps you save money regularly without wanting to spend it. 💳💡

5. Look into investment options with low risk

Investing is important even if you don’t have a lot of money:

- Public Provident Fund (PPF): Gives tax breaks and a safe long-term return.

- Recurring Deposits (RDs): Let you make set monthly contributions that are sure to earn you money back.

- Mutual Funds through SIPs: You can start with as little as ₹500 a month and watch the market grow over time.

These choices help your money grow regularly, which is good for your savings. 📈📉

6. Save money for hard times

Try to save enough money in a different account to cover your costs for three to six months. This fund keeps money aside in case something unexpected comes up, so you don’t have to rely on loans or credit as much. 🆘

7. Make extra money

You could look for part-time jobs or independent work to make more money. Platforms that give online teaching, content creation, or digital services can help you make extra money and be more financially stable. 💼💻

8. Take advantage of government schemes

Use apps that are meant to help you save money and make investments:

- The Atal income Yojana gives people a set income when they leave.

- The Sukanya Samriddhi Yojana is a great way for people with girls to save money with high interest rates.

- National Savings Certificates (NSC) are a safe way to spend your money and they also give you tax breaks.

With these plans, you can save money in a planned way and get extra benefits. 🇮🇳📜

9. Make smart choices about how you spend your money

Adopt techniques for spending money wisely:

- Avoid Impulse Purchases: Do not buy anything that isn’t necessary for 24 hours.

- Use Cashback and Discount Offers: Use deals to save money on things you need to buy.

- Limit subscriptions: Cancel services you’re not using to avoid spending money on things you don’t need.

These habits help you save more money and handle your money better. 🧠💡

10. Look over your plan often and make changes as needed

Every month, set aside some time to look at your cash results. If your income or costs change, make sure that your budget and savings goals still match up. This preventative method makes sure that your financial plan stays useful and up-to-date. 🔄📆

📌 Conclusion: Giving You Power on Your Financial Journey

To live in India on a ₹30,000 income, you need to plan ahead and be responsible. By taking these useful steps, you can build a strong financial base that will allow you to enjoy future growth and security. Remember that steady work and smart choices are the keys to financial success. 🚀

✨ Check out HDFC Life’s savings tips and Paybima’s money-saving strategies for more personalised advice and tools to help you manage your money well. ✨