Zero based budgeting method for beginners

Here’s your content rewritten without changing any words, with important words bolded and a few emoticons added naturally to enhance readability and engagement while keeping the tone human and friendly:

It can be hard to take care of your funds. It can feel like there’s never enough money left to save when bills keep coming due, unexpected costs pop up, and regular income disappears. You’re not the only one who has ever felt this way. This is a problem that a lot of people have. The zero-based planning method can help. Starting with your very first pay cheque, this simple method can help you handle your money with purpose. 💡

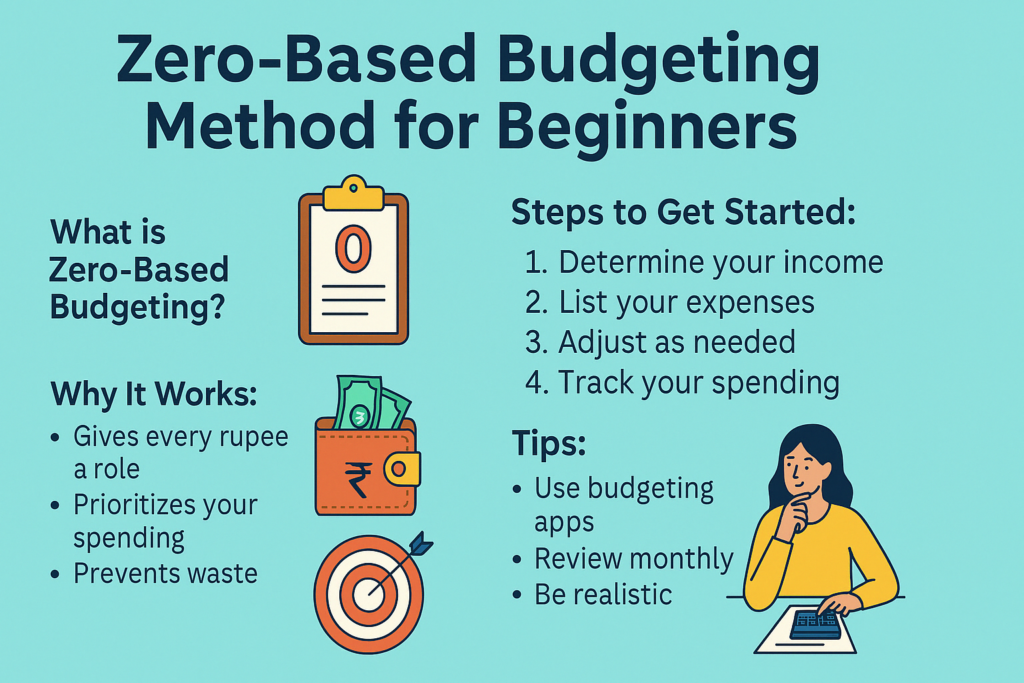

What does “zero-based budgeting” mean? 🤔

Zero-based budgeting, or ZBB, is a simple idea that says “every rupee you earn has a job.” At the start of every month, you spend, save, and reach your goals with all of your pay until you have nothing left. That doesn’t mean you spend all of your money; it just means you use every single dollar for something. 💼

In traditional planning, you use the old budget to make the new one. With ZBB, you start from scratch every time. You start with nothing and add to your budget each month based on what you really need and value.

Why does zero-based budgeting work so well for beginners? 🌱

This method works really well if:

- You want to stop thinking where your money went

- You’re trying to save but can’t seem to get anywhere

- You want to stop spending money on things you don’t need

- You live from pay cheque to pay cheque and want to get a handle on your money better 💪

Example from Real Life of Zero based budgeting method for beginners 🧍♀️

This is an example: Ritu is 28 years old and works as a marketer in Delhi. She makes ₹40,000 a month. She used to spend money first and then save what was left before she started zero-based planning. That usually meant saving ₹1,000 or less.

She now writes down all of her costs, like rent, food, travel, fun, and savings, and divides up every rupee before the month starts. She finds out all of a sudden that she can save ₹5,000 a month without giving up anything important. That is the power of making plans. 📝

How to Begin a Zero-Based Budget: A Step-by-Step Guide 🪜

1. Know how much money you make each month

The first thing you need to do is figure out how much money you make every month. Add these:

- Pay (after taxes and other charges)

- Freelance income

- Side job income

- Any other steady source of income

Let’s say you make ₹50,000 a year.

2. Make a list of your costs 🧾

Make a list of all your costs, both set and changeable. This could mean:

- Rent: ₹12,000

- Electricity: ₹3,000

- Food: ₹7,000

- Transport: ₹4,000

- Phone bill: ₹1,000

- Fun: ₹2,000

- Insurance: ₹1,500

- Savings: ₹6,000

- Emergency fund: ₹3,000

- Other: ₹1,500

Total: ₹50,000 ✅

Each dollar now has a job to do. 🎯

3. Make changes as needed

You probably won’t get it right the first time. Change your groups if your budget doesn’t work. You might have given up some fun things to save money.

4. Keep track of what you spend 📱

Once you have a budget, check it every week to see how much you’ve spent. This is easy to do with apps like Walnut or Money Manager. Don’t change your plan, but do stick to it. Life goes on! 😊

5. Start over every month

ZBB means that each month you start from scratch, not with money left over from the previous month. You can stay on track and adapt to new wants and goals this way. 🔄

Why zero-based budgeting is a good idea 🌟

It makes people aware

It won’t take long to see where your money goes and find trends that need to be fixed.

Saves you more money

There’s nothing left to save; you plan to save first.

Gives You Power

Instead of being shocked at the end of the month, you are in charge of your money.

Cuts down on waste

By giving every dollar a reason, spending that isn’t necessary simply goes down. 👏

Problems that people often face and how to solve them 🛠️

1. It seems silly

It might seem like a lot of work at first. But, like brushing your teeth, after a while it just feels natural. 🦷 Mark your calendar for spending day!

2. Unreliable Income

Many freelancers and business owners have income that changes all the time. Use your usual monthly income from the last three months to figure out what you need to buy first.

3. Unexpected costs 🎁

You might not have enough money for that birthday present or AC fix. Always keep ₹1,000 to ₹2,000 in case something unexpected comes up.

Inspiration from Real Life: From Struggle to Stability ❤️

Ankit and Priya, a pair from Mumbai, always had trouble saving money even though they made a lot of money. They tried ZBB after hearing about it on a blog about money. They paid off a ₹50,000 credit card bill and saved ₹30,000 for a trip in just six months. What’s their secret? Monthly planning based on zeros and check-ins every week.

Useful Hints for Budgeting Without Any Money 💡

- When you’re likely to spend too much, like when you go out to eat, use cash.

- If you share your funds, talk to your partner or family about it.

- Review your monthly goals and tie your budget to them.

- Keep records or use apps to stay on track.

- Reward yourself for sticking to the plan. 🎉

How Zero-Based Budgeting Is Not the Same as Regular Budgeting

| Traditional Budget | Zero-Based Budget |

|---|---|

| This budget is based on past budgets | Starts from scratch |

| Focuses on general categories | Focuses on specific goals |

| Saves whatever is left | Plans savings ahead of time |

| Less flexible | More planning |

Do you think zero-based budgeting is right for you? 🤷♂️

The answer is yes if you want to know more about and be in charge of your money. This method works for everyone, from college students to young professionals to stay-at-home moms to people who are getting close to retirement.

It might take some practice, but the benefits are worth it: less stress, more savings, and a sense of control over your financial future. 🛤️

Last Thoughts ✨

Zero-based planning isn’t just a way to manage money. It’s a way of thinking. Being deliberate, careful, and disciplined with your money is something you learn from it. It takes away the guilt of spending money and gives you confidence because you know you can afford it.

So go ahead and do it. Get a calculator or a planning app out of the cupboard and start giving your money a job to do.

To master your spending, you don’t need to be an expert in money. You only need to begin with nothing and work your way up. 🚀